Last updated January 29, 2026

Table of Contents

- 2026 trends shaping premium creator pricing

- Highest-paid influencers right now (latest published estimates + why brands pay)

- Quick comparison table

- Cristiano Ronaldo

- Lionel Messi

- Selena Gomez

- Kylie Jenner

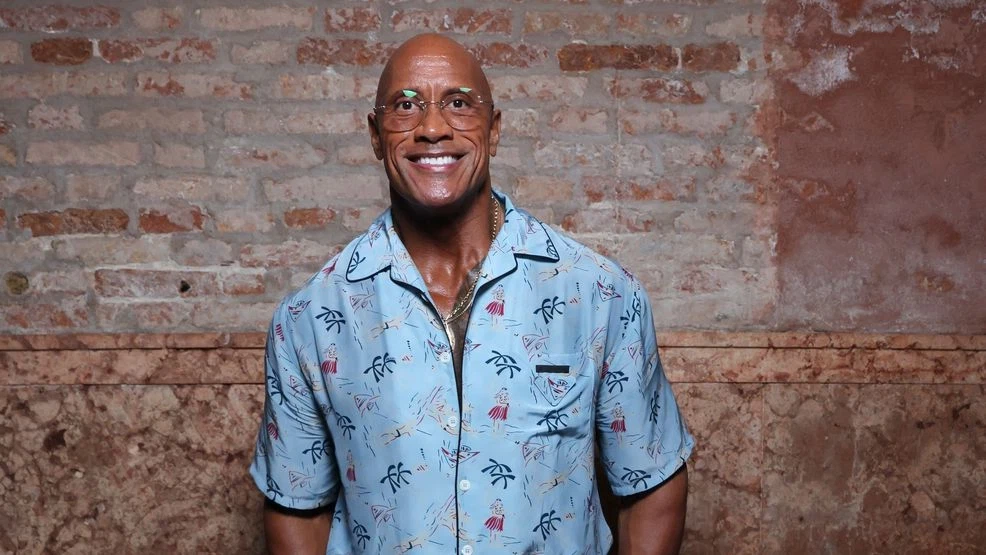

- Dwayne “The Rock” Johnson

- MrBeast (Jimmy Donaldson)

- Dhar Mann

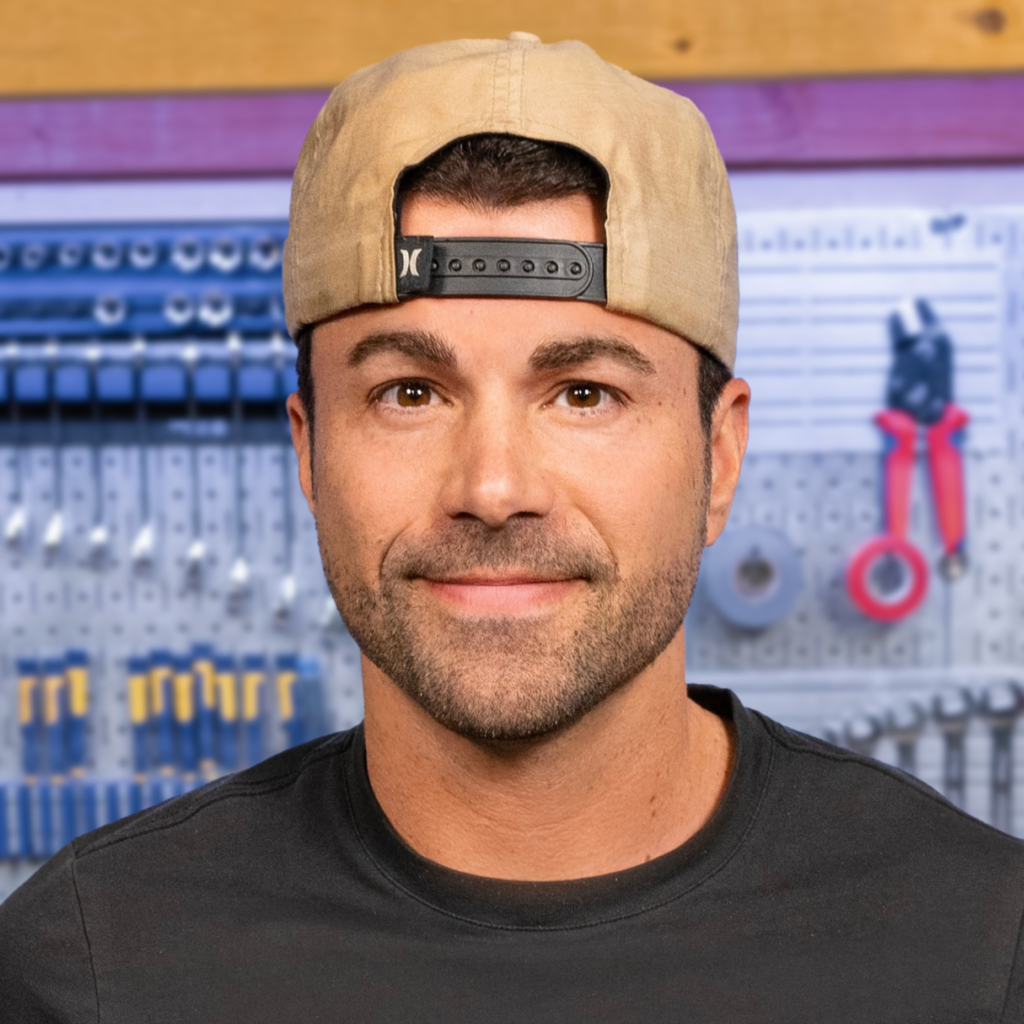

- Mark Rober

- Jake Paul

- Khaby Lame

- Pricing benchmarks by platform (2025–2026 deal reality)

- Directional benchmark ranges (starting points)

- How to use this list without wasting budget

- FAQ: Highest paid influencers in 2026

- Common questions

In 2026, “highest-paid influencer” can mean three different things, and confusing them leads to overspending. First, it can mean the highest estimated sponsored-post price on a single platform, most commonly Instagram. Second, it can mean the creator’s total annual earnings, which includes ads, licensing, subscriptions, commerce, products, and equity deals. Third, it can mean the creators who consistently command premium pricing because their content can be repurposed into paid media at scale.

That third category matters more than ever because brand deals increasingly include paid usage rights and whitelisting, which can turn a creator partnership into a full-funnel asset. Exclusivity clauses also push pricing up rapidly, especially in beauty, sportswear, and beverage where competitor adjacency is tightly controlled. Modern deals rarely involve “one post”—they bundle short-form video, Stories, link placements, and sometimes livestream or creator-led landing page content.

Many top creators price in production operations as well: teams, editing, and compliance review. The takeaway is simple: “highest-paid” is about the creator’s ability to convert attention into measurable outcomes under brand-safe terms, not just celebrity status.

2026 trends shaping premium creator pricing

Premium pricing is increasingly tied to rights and distribution, not just the organic post. Brands pay more for multi-month usage rights so creator content can run as paid social, retail media creative, OTT placements, or website assets without renegotiation. Creator whitelisting has matured into a mainstream channel because performance teams want to buy from the creator handle while controlling spend and optimization.

Social commerce is also shifting budgets toward product-led creator partnerships because conversion tracking and payout alignment are cleaner. Short-form shopping behavior pushes creators with strong product fit into higher pricing tiers even if they have fewer followers.

Affiliate and curated-shopping ecosystems professionalize monetization, making “flat fee vs. commission” a real strategic decision. Brand safety has become a measurable pricing lever too: low-controversy creators with stable audience trust can charge more because they reduce downstream risk. Finally, production value keeps climbing, and the best creators now operate like media companies—repeatable formats, teams, and reliable output.

The result is a 2026 market where the most expensive creators are often those who can deliver a scalable content system, not just a viral moment.

Highest-paid influencers right now (latest published estimates + why brands pay)

The roster below blends two “highest-paid” lenses competitors often separate: (1) top-of-market sponsored content pricing signals and (2) creators with business-scale monetization. Instagram “rich list” style estimates help map ceiling pricing, while annual earnings coverage highlights creators with operational maturity. Images are provided via Wikimedia Commons file pages so you can download and upload them into WordPress with attribution.

If you’re building a multi-creator program, a common high-performing approach is selecting two reach anchors and surrounding them with category specialists who can sustain performance. For a managed approach, many teams prefer working with an influencer agency that can package talent, content licensing, and reporting under one scope.

Quick comparison table

| Influencer | Primary platforms | “Highest-paid” lens | Typical premium driver | Best-fit categories |

|---|---|---|---|---|

| Cristiano Ronaldo | Ultra-premium per-post tier | Global reach + sponsorship gravity | Sportswear, lifestyle, tech, beverage | |

| Lionel Messi | Ultra-premium per-post tier | Trust + family-safe alignment | Sports, family, QSR, consumer goods | |

| Selena Gomez | Ultra-premium per-post tier | Culture relevance + beauty adjacency | Beauty, wellness, fashion, entertainment | |

| Kylie Jenner | Ultra-premium per-post tier | Beauty-commerce engine + trend velocity | Beauty, fashion, lifestyle | |

| Dwayne “The Rock” Johnson | Ultra-premium per-post tier | Mainstream appeal + brand-builder credibility | Fitness, grooming, beverage, entertainment | |

| MrBeast | YouTube + multi | Top annual-earnings tier | Mass-scale production + repeatable formats | CPG, retail, apps, QSR |

| Dhar Mann | YouTube | Top annual-earnings tier | High-volume story content + brand-safe tone | Family brands, apps, consumer services |

| Mark Rober | YouTube | Top annual-earnings tier | STEM authority + sponsorship trust | EdTech, tech, STEM toys, tools |

| Jake Paul | YouTube + Instagram | Top annual-earnings tier | Event-driven spikes + audience intensity | Sports, entertainment, beverage (where allowed) |

| Khaby Lame | TikTok + Instagram | Top annual-earnings tier | Universal short-form language | Consumer goods, mobile, retail |

Cristiano Ronaldo

Ronaldo remains the clearest example of top-of-market sponsorship pricing because his audience is massive and commercially conditioned to sports endorsements. Brands pay a premium for global reach paired with a fanbase that expects major partnerships.

His content mix—training, match moments, family visibility, and lifestyle—creates several natural entry points for brand storytelling without awkward scripts. For international launches, he provides cross-border consistency that few creators can match. The highest-value packages typically include Stories and link placements because those formats carry the conversion layer. Many enterprise deals also treat Ronaldo as “hero creative” that can be licensed into paid media, which changes the economics beyond the organic post. If you’re buying for performance, negotiate usage rights and build an amplification plan around the creative. If you’re buying for brand equity, align the partnership to a clear moment such as a tournament window or product launch.

Expect strict approval flows and strong exclusivity constraints in adjacent categories. The campaigns that win are built on one clear concept, tight rights terms, and realistic timelines.

Best-fit campaign types

- Global brand launches

- Sports lifestyle positioning

- Premium sponsorship storytelling

Negotiation focus

- Usage rights

- Exclusivity windows

- Paid amplification/whitelisting terms

Lionel Messi

Messi commands premium pricing for a different reason than many celebrities: brand alignment is broadly family-safe and low-friction.

That matters in 2026 because brands increasingly price in reputational risk and long-tail reuse of creator content. His audience is global, with deep strength in football-first markets that pay attention to sponsorships. Brands buy trust and stability as much as reach, especially in categories where safe mainstream wins over edgy virality. His best partnership integrations are usually simple and product-forward, because his audience relationship is anchored in sport and family narrative. If you need more than awareness, build a package with multiple touchpoints rather than a single post, because conversions often happen in Stories and link activations.

Messi is also a strong fit for campaigns with a community component, where credibility is hard to buy with ads alone. The most effective briefs avoid overcomplicated copy and instead focus on one message and one action. Plan for tighter scheduling around travel and matches, which affects delivery timelines. He remains top-tier for global visibility with fewer brand-safety tradeoffs than many peers.

Best-fit campaign types

- International launches

- Sports sponsorships

- Family-safe mass campaigns

Negotiation focus

- Deliverable bundling (post + Stories)

- Link placements

- Exclusivity clarity

Selena Gomez

Selena Gomez stays premium because her audience spans entertainment culture and beauty-adjacent purchase behavior. Brands pay more when a creator’s relevance persists beyond one platform cycle, and her presence remains stable across formats. The strongest sponsorships feel like extensions of her aesthetic rather than hard pivots into sales language.

In 2026, that matters because high-value creator content is often content brands want to license and run as paid creative. If you’re negotiating, assume usage rights will be a major cost lever, especially in beauty, wellness, and fashion. She is also a strong pick for campaigns that need cultural legitimacy outside social media. Brands that over-script these partnerships usually lose value because the audience responds better to controlled but natural tone.

A smart structure separates base deliverables from optional paid-media licensing so you don’t pay for rights you won’t use. If the campaign needs direct response, pair it with a clear landing experience and trackable offer. She’s best treated as a brand-building partner with optional performance layers, not as a pure conversion engine.

Best-fit campaign types

- Beauty launches

- Cultural moments

- Premium brand storytelling

Negotiation focus

- Licensing/usage rights

- Creative controls

- Optional performance add-ons

Kylie Jenner

Kylie Jenner remains premium because her influence is tightly connected to beauty and lifestyle commerce. Brands pay for how quickly her posts can move attention, especially when the product fits the beauty and fashion adjacency her audience expects.

In 2026, “highest paid” for creators like Kylie often reflects cross-format packaging rather than a single static post. The more the campaign is product-forward, the more it benefits from her audience’s purchase-ready behavior. If you’re building a premium partnership, plan creative so it can also be used in paid media because that’s where much of the value sits now. Category exclusivity is often the biggest pricing lever because adjacent brands compete aggressively for the same attention. Timing also drives cost as launches and seasonal moments compress demand.

Protect ROI by defining deliverables precisely, including revision limits, usage territory, and paid duration. If you need conversion, build a frictionless shopping path that matches how audiences buy in 2026. The campaigns that work best are visually clean, product-led, and supported by a strong offer.

Best-fit campaign types

- Beauty drops

- Fashion collaborations

- High-velocity product launches

Negotiation focus

- Exclusivity

- Usage rights

- Timing windows

- Cross-format bundling

Dwayne “The Rock” Johnson

Dwayne Johnson’s premium pricing comes from massive reach plus a brand persona that naturally fits mainstream categories. His audience expects fitness, motivation, entertainment, and endorsements, so sponsorships can feel native.

In 2026, brands also pay for reliability, and his content cadence historically supports planned campaign windows. Strong partnerships tap a clear theme—training, recovery, or lifestyle upgrades—so the message feels cohesive. He’s also a good candidate for licensing because the creative tends to be broadly usable across channels and geographies. If your brand needs both awareness and credibility, he can function as a trust anchor while smaller creators carry the conversion layer.

Pricing rises quickly when deals include multi-month category restrictions, since he touches many adjacent verticals. To avoid wasted spend, commit to a concept that can live beyond one post in paid media and owned channels. Operationally, assume a professional approval process and build timeline buffers. He remains a premium choice for brands that want scale with a predictable brand-safety profile.

Best-fit campaign types

- Fitness and health positioning

- Mainstream CPG

- Entertainment tie-ins

Negotiation focus

- Category exclusivity

- Reuse/licensing

- Deliverable scope clarity

MrBeast (Jimmy Donaldson)

MrBeast represents the 2026 definition of “highest paid” that matters most: a creator-run media company with repeatable formats and massive distribution.

Brands pay premium rates because integrations are built into high-production narratives that hold attention longer than typical ads. His value isn’t just reach; it’s the ability to produce cultural moments that get clipped and shared.

Business coverage of top creator earnings consistently places him near the top tier, reflecting multi-revenue monetization beyond sponsorships. For brands, there’s operational upside because the channel comes with strong production infrastructure and predictable delivery standards. The key risk is demand—brands without a strong concept can underperform. If you want performance, you typically need a broader package: integrated placement, short-form cutdowns, and paid amplification rights.

These partnerships also work well for retail and app brands because the audience accepts clear calls-to-action. Treat usage rights as a separate line item because repurposing can be where ROI lands. He’s a premium partner when your brand can support a big concept, not when you only need a simple awareness impression.

Best-fit campaign types

- High-impact launches

- Mass retail pushes

- App acquisition with creative scale

Negotiation focus

- Integration design

- Cutdown rights

- Paid amplification strategy

- Exclusivity

Dhar Mann

Dhar Mann’s premium value comes from high-volume narrative content that supports predictable, repeatable sponsorship integration.

In 2026, brands increasingly prefer consistency because content is often repurposed across channels. He is frequently referenced in creator-earnings coverage, which signals a durable business model beyond one-off deals. Brands pay for a brand-safe tone and broad household reach, especially for consumer services and family categories. The best integrations place the product in a simple “problem/solution” role rather than forcing a hard endorsement. If you need production at scale, his content operation can support larger packages and clear timelines.

For performance, CTA design matters because the audience is there for story first. Strong deals define usage rights clearly since clipped segments can generate many secondary impressions. Brands should still do adjacency checks because story topics can span sensitive themes. He’s a premium partner when you want safe narrative integration at scale, not when you need niche technical authority.

Best-fit campaign types

- Family brands

- Consumer apps

- Mainstream services

Negotiation focus

- Story integration placement

- CTA design

- Usage rights

- Deliverable volume

Mark Rober

Mark Rober commands premium sponsorship economics because trust and authority are embedded in the content.

In 2026, that trust premium matters because audiences quickly reject ads that don’t match expertise. Brands pay for credibility in STEM-adjacent categories where explanation can increase conversion without sounding like a commercial. He fits the licensable creative model well because the content tends to be evergreen. Earnings coverage often includes him among top creators, reflecting durable monetization beyond occasional brand posts. The best partnerships focus on products that can be demonstrated, because demonstrations match audience expectations. If your product has educational friction, his format can reduce it, which is a real performance lever for consumer tech and STEM kits.

Negotiation should define cutdown rights because repurposed segments often outperform the original as ads. Brands should plan for higher creative scrutiny since the integration must remain accurate. He is a premium choice when you need both attention and technical persuasion, not when you want a celebrity cameo.

Best-fit campaign types

- Consumer tech

- EdTech

- STEM toys

- Tools and hardware

Negotiation focus

- Demo integration

- Reuse rights

- Cutdowns

- Accuracy/compliance review

Jake Paul

Jake Paul sits in the “highest paid” tier because monetization is built around audience intensity and event-driven spikes. Brands typically buy momentum—fight-week attention and cultural noise—more than evergreen reach. Creator-earnings coverage often references him, suggesting a broader monetization stack beyond sponsorship posts.

In 2026, that matters because creators with multiple revenue lines tend to have higher operational leverage. The key to success is aligning the brand to a moment and storyline, because generic placements underperform. Brands should treat risk management as part of the buy, including approvals and adjacency constraints. If you want measurable outcomes, structure the campaign with trackable offers tied to the event window. Paid amplification can work well if you negotiate clip rights clearly.

The audience can be polarizing, so category fit and regulatory constraints must be checked early. He’s a premium partner for brands that can handle high visibility and want attention spikes, not for conservative long-horizon positioning.

Best-fit campaign types

- Sports and entertainment tie-ins

- Event-driven launches

Negotiation focus

- Brand safety

- Timing windows

- Clip rights

- Performance tracking

Khaby Lame

Khaby Lame’s premium value comes from a short-form language that travels across markets with minimal translation.

In 2026, that global scalability is a major advantage for consumer brands. His best sponsorships preserve the simplicity of the format because overproduction can reduce clarity. Premium pricing here often reflects adaptability: the ability to produce multiple narratives quickly without diluting authenticity. He’s particularly strong for products that benefit from visual “before/after” clarity or simple demonstrations.

Smart deal structures bundle multiple short videos because frequency is a real lever in short-form performance. If you plan to run the content as paid ads, negotiate usage rights early because the clips are often repurposed into strong paid units. Brands should also specify how product claims are handled, because simplified formats can accidentally oversimplify regulated categories.

In 2026, he remains a premium pick for global brands that want universal comprehension and fast creative iteration. He’s best used when product utility is visually obvious and the brand can commit to a multi-asset approach. The result is usually more efficient than a single hero post.

Best-fit campaign types

- Consumer goods

- Mobile apps

- Retail

- Convenience-driven products

Negotiation focus

- Multi-clip packages

- Usage rights

- Claim compliance

- Paid amplification

Pricing benchmarks by platform (2025–2026 deal reality)

Even in 2026, the cleanest budgets start with benchmarks by creator tier and then adjust for rights and distribution. Pricing varies, but benchmarks still cluster around tiers and platform norms for one-off deliverables before you add licensing.

Once you move into celebrity territory, public estimates become signals of ceiling pricing rather than fixed rate cards. For many enterprise campaigns, base fees are no longer the largest line item because usage rights and whitelisting can scale the spend quickly. If your plan includes paid amplification, your media team should be involved early because the rights package determines what you can do later. Exclusivity should be treated like insurance, purchased only when it protects something real.

Performance structures can reduce upfront fees while protecting ROI, especially in commerce-heavy campaigns. Separate “content production” from “media distribution” so reporting stays clean and optimization stays possible. In practice, the final price is driven by deliverable scope, rights duration, and distribution intent.

Directional benchmark ranges (starting points)

| Tier | Typical follower range | Common deliverable | What increases price fastest |

|---|---|---|---|

| Nano/Micro | 1K–100K | 1 short video or 1 post | Usage rights + whitelisting |

| Mid/Macro | 100K–1M | Video package + Stories | Exclusivity + multi-platform bundling |

| Mega/Celebrity | 1M+ | Campaign package | Global rights + strict restrictions |

How to use this list without wasting budget

Start by deciding whether you need a reach anchor, a performance engine, or a creative licensing asset, because those are different buys in 2026. If you only need awareness, you can often get better efficiency by pairing one premium name with several category specialists. If you need performance, plan around content reuse and amplification and negotiate rights accordingly.

Build briefs around one clear promise and one action because premium creators don’t need heavy scripts to deliver impact. Treat exclusivity like a scalpel and define categories precisely to avoid overpaying. Avoid single-deliverable deals when possible because variation and repetition drive real lift.

Put measurement into the scope up front: link logic, UTMs, offer structure, and reporting cadence. Standardize deliverable definitions across creators so your team can compare performance cleanly. Many teams prefer an experienced best influencer marketing agency to manage contracting, creator ops, and usage-rights governance across programs. The brands that win treat creators as scalable media partners—creative, distribution, and measurement—not isolated posts.

FAQ: Highest paid influencers in 2026

The most expensive influencer is not always the highest paid because total earnings often come from businesses and commerce, not one sponsorship. Instagram “rich list” estimates are useful for ceilings, but real deals are negotiated around deliverables and rights. The fastest-growing premium line items are usage rights and whitelisting because brands want to turn creator content into scalable paid creative.

Annual earnings lists are better for identifying creator-operators with reliable production infrastructure. Celebrities tend to win at reach and brand equity, while creator-entrepreneurs often win at repeatable creative systems.

The biggest ROI mistakes happen when brands buy a premium name without a plan for distribution and measurement. If you need conversion, prioritize trackable offers and frictionless shopping paths. If you need brand lift, build around a moment and a memorable concept. The “right” highest-paid influencer depends on category fit, audience alignment, and your funnel goal. Most teams get the best outcomes by blending one premium anchor with the right supporting creators and a rights plan that lets them scale winners.

Common questions

- Are per-post rates “real”? They’re directional estimates; contracts depend on rights, exclusivity, and bundling.

- What’s the biggest pricing lever in 2026? Usage rights + whitelisting/paid amplification.

- Should brands hire celebrities or creators? Use celebrities for broad equity and creators for repeatable content systems, then blend based on funnel goals.

Sources:

[1] https://influencermarketinghub.com/influencer-marketing-benchmark-report/

[2] https://www.linqia.com/2026-state-of-influencer-marketing/

[3] https://sproutsocial.com/insights/influencer-pricing/

[4] https://www.hopperhq.com/instagram-rich-list/

[5] https://www.wppmedia.com/news/unfiltered-2026-the-evolving-landscape-of-creator-marketing

[6] https://impact.com/influencer/influencer-marketing-trends-performance/

[7] https://www.creatoriq.com/blog/influencer-marketing-trends-2026

[8] https://ads.tiktok.com/help/article/spark-ads

[9] https://www.facebook.com/business/help/342728904797642

[10] https://www.forbes.com/sites/stevenbertoni/2025/06/16/forbes-top-creators-2025/